Please see previous posts first for context, answers to common objections and supporting evidence provided for modelling crashes.

Most recent -

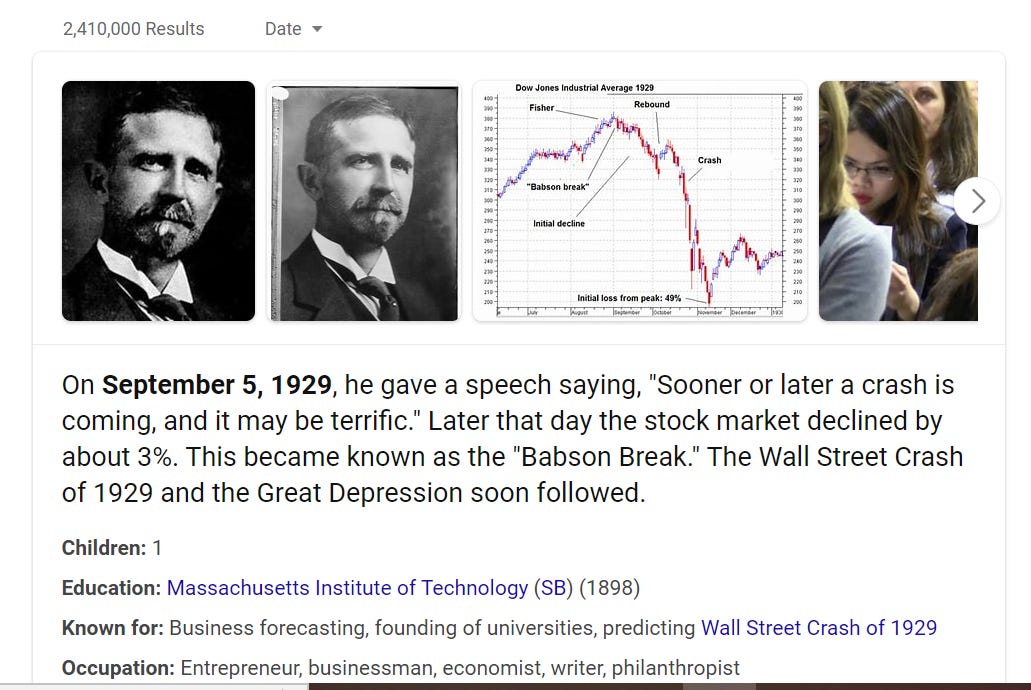

The drop out of the topping range in the DJI of 1929 was known as the “Babson Break”.

Around the same time would also be made one of the most famous mis-forecasts a market move:

In October of 1929, economist perma-bull Irvin Fisher gave an address where he explained his theory as to why the bull market would continue and the current decline (Of about 10%) was nothing to worry about. He's say stocks has dropped 30% (They made a new high) and then some 10% off the recent high. He'd say the reason for the selling was leveraged investors being margin called. That the market was still absolutely fine for people who do not use leverage.

He's say stocks has dropped 30% (They made a new high) and then some 10% off the recent high.

This is also true of current times. We dropped 30% in March, made a new high and at the time of posting this video we were 10% down from the current high.

Here was the Babson break in 1929.

If we make the swing conditions of the previous post, we’ll be matching the conditions of the Babson break section of the 1929 high.

Do we have a lot of coincidences? Or has it never really been all that different? I don’t think there’s too much longer to go to find out.