In this analysis we’ll do a breakdown of both the reasons it makes sense look for macro trend risk and some specific markers we have telling us we may be close.

For more regular updates and trade plans join:

Please note, “Close” is a relative term here. We could still be 10% or so from the high and if we are, this can be the most aggressive part of the move.

But we’re in an area where there’s a lot of risk.

Let’s start with the biggest perspective.

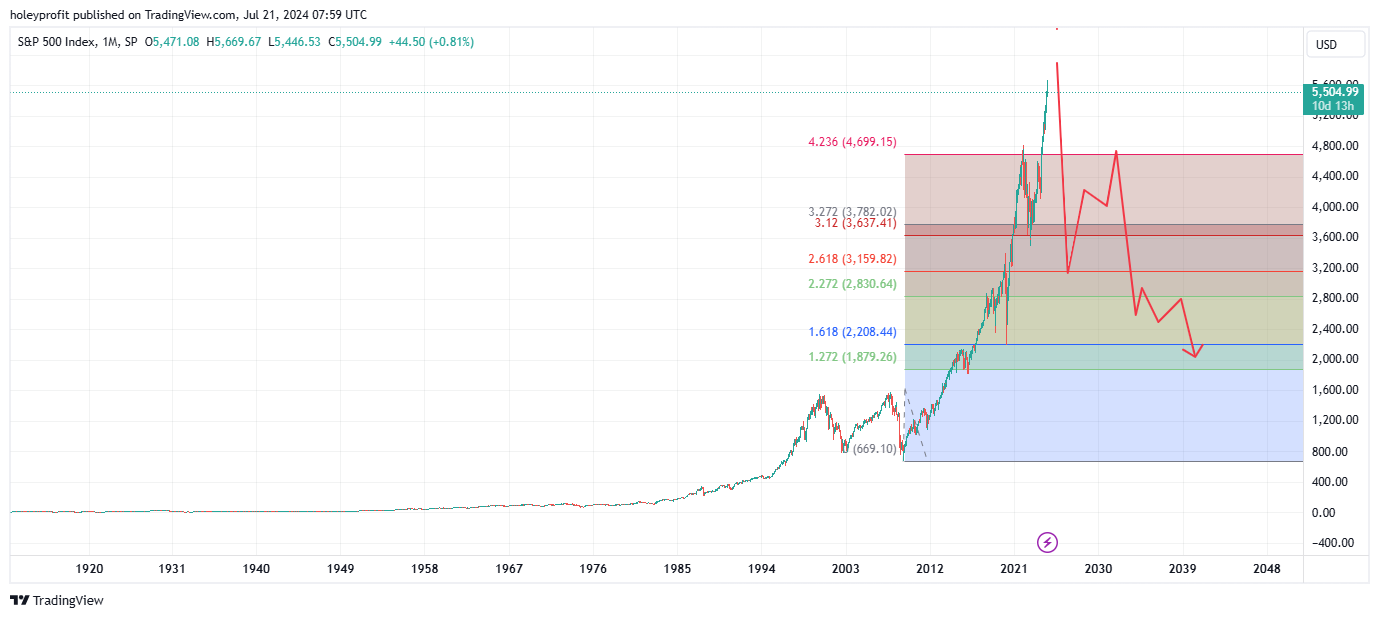

Multi Decade Resistance

Heading into the 1920’s rally, DJI made a 50% crash. The rally would ultimately go on to be a 4.23 extension of this crash.

It chopped around there for a while. Spiked out, and then the crash had begun.

Here’s a picture from close to the 2022 high. When we first hit the 4.23.

This is how we look now.

Here’s another 4.23 top. This one from BB in 2021.

The BB spike resolved like this.

Which didn’t surprise me. I’ve been setting targets and trading reversals from 4.23s for years.

But have never seen one this big in the wild.

The previous fibs mark out the major highs and lows in the market since them.

The 4.23 rejection would be the biggest trade these fibs would have predicted so far, and they’d have predicted the high and low points of 2020 and 2022.

A full 4.23 rejection trade would be disastrous. The 4.23 mean reversion path is a drop to the 2.61 followed by a drop to the 1.27.

Here’s the OG.

And the percentage drop that would forecast would be the same type of percentage drop seen in DJI 1929, Nikkei 1990 and Nasdaq 20000.

Here are all of those together.

Were one to express the implied forecast of this model with a mountaineering analogy, we’d on the summit advance now. Which is often a little mountain on top of a mountain.

The zone they call the “Death zone” on the major peaks.

If we’re not at the actual top, but we’re getting to the top - then the final accent is going to be the steepest part of it.

I’ve been speaking for months about the style in which a final short squeeze forms.

But, if this thesis is correct, in the grand scheme of things we’ve seen best of this rally now.

Anyone calling for a bubble top here will look like a genius in ten years. As traders, the devil’s in the detail. We’re not here to look clever, we’re here to make money.

If we head into a squeeze it’s possible we see day after day of relentless rallying. In the same style we’ve seen RUT and DJI moving recently.

There’s a difference between bear market rhetoric and bear market strategy. The moment before the perfect moment is the worst moment.

But I do feel some strategic bets on a crash coming up. I don’t think SPX has topped quite yet, but I do now believe we may be late inside of the topping process.

More detailed plans on how we’ll deal with a squeeze and can we can begin to plan, and position for, a jackpot bear attempt in the near(ish) future.