The bear market may have failed.

Shorts should be super careful now. It's a good time to protect yourself.

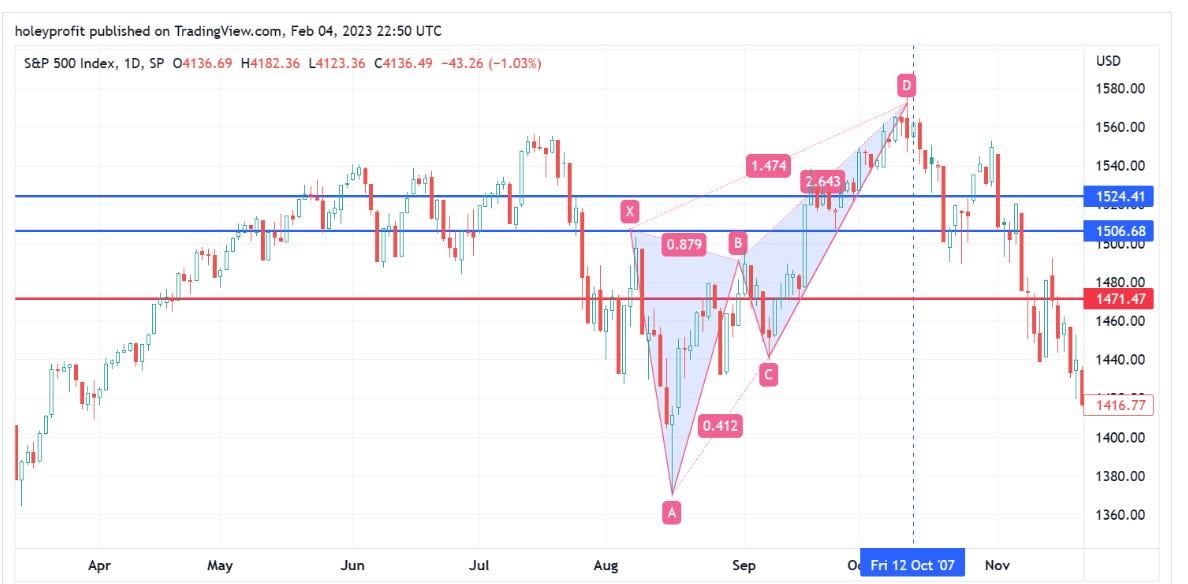

Indices have failed to make the classic crash patterns. While we may just have had a funky spike out to trick people onto the wrong side of the market, we might have seen a failure of the bear here. If it’s a trick, they’ve tricked me.

A classic market downtrend should have made a high here.

Trading above there puts bears in serious danger.

I think it would be unwise to be a bear at this time. If we get back under 4000 this is more enticing for the bear case but as we’re around 4090 - 4070 I think this is the time to ensure you would not be hurt by a big rally. I think the overall bear market is still going to happen, but the bears may get the horn first.

My comments are mainly for those speculating short. We have risk. For those who are investors - I think you may see prices a bit higher but it’s still not good to get into the water. While there may be bull moves before a bear market begins, I suspect the 5 yr return on SPX at this level will be negative.

If we’ve transitioned to an uptrend, the low should be made soon.

We’re getting into this retracement level now.

The classic crash models have failed and it may well be because we’re not into the actual bear yet. We may be one swing too early.

Much like the 2007 move.

We’ve made a full exit of swing shorts recently.

Will update if we make a bearish breakout. If not, we will update higher when we think there’s good value to the short again.

With well placed stops, it may be a good speculative long here.

I do re-iterate, I think if we rally we’re going to see a stop run and not a new bull market. Investors would do well to offload their risk into any rallies if they’re worried about big drawdowns. 2022 may only have been a sample of what’s to come.